Johnson & Johnson is the world's biggest R&D investor

Jul 02, 2024Johnson & Johnson is the world's biggest R&D investor

Source: MedTF

The amount of research and development investment is related to the future growth space of the enterprise, under the premise of not clicking the wrong science and technology tree, the more research and development investment means the greater the growth space of the future enterprise. In the field of communications and the automotive industry, we can see the brilliant achievements of companies with huge R&D investment

Like BYD in the automobile industry, it has been called the "shame of domestic goods" and now the light of domestic goods. It is because BYD has invested for more than ten years, so that it has accumulated in technology, and BYD's research and development investment was as high as 40 billion last year.

In the field of communications, Huawei is a reflection of the backbone of people abroad, and it has survived under the pressure of the United States. In addition to Huawei people here have backbone, it is more important that Huawei is willing to invest. Last year, it invested 164.7 billion yuan in research and development, accounting for 23.4% of sales. No medical device company can afford such a high investment in research and development. Even Johnson & Johnson, Medtronic can not reach, of course, most of the domestic medical device companies can not.

The R&D investment of the first brother of domestic equipment reached 3.779 billion last year, accounting for 10.82% of sales. In the first quarter of this year, Mindray's R&D investment continued to increase steadily, reaching 10.99% of sales. High research and development investment is also buying a steady increase in the global market ranking, last year it rose to 27 in the world, and the end of this year is expected to rise further, and the top 20 is just around the corner. If domestic medical devices want to become a global leader like automobiles and communications, they need more willing to invest in the company like Mindray. It is expected that in the next 5 to 10 years, domestic device companies will also be among the top ten in the world and start to lead the development of global medical devices. If you want to make yourself strong, you need to find a reference. The world's top medical device company is undoubtedly the best benchmark and target for domestic enterprises. Let's take a look at how these top companies spend their R&D dollars.

NO.1 Johnson & Johnson

Research and development spending: $3.12 billion, 10.2% of sales J&J has been No.2 since losing its top spot to Medtronic in 2015. But for the former first brother, who has endured humiliation for nine years, it is time to return to the throne of first brother. In 2021, J&J replaced its chief executive, Joaquin Duato. The new president took office to divest the consumer health business, focus on medicine and medical devices, and increase investment in medical devices, especially in the cardiovascular field. Starting in 2022, Johnson & Johnson has spent more than $16 billion to acquire Abiomed, $13.1 billion to acquire Shockwave, $400 million to acquire Laminar and so on. Heavy investment has also brought a surge in Johnson's medical device revenue, leaving it with a gap of only $800 million with Medtronic. Combined with the acquisition of Shockwave sales this year, Johnson & Johnson is likely to surpass Medtronic and return to the throne next year. In addition to spending heavily on mergers and acquisitions, J&J is also increasing its investment in research and development, from less than 8% to more than 10%, 1.5% more than Medtronic. Heavy investment in research and development has also allowed J&J to blossom in three areas.

- Surgical field

In the field of surgery, Ottava, which has been having difficulties in childbirth, finally has new news, and will submit an IDE application to the FDA this year, and will soon begin clinical studies.

Echelon Linear, a new generation of linear cutting stapler, is also introduced, which can reduce the incidence of anastomotic leakage by 47%.

Echelon Linear, a new generation of linear cutting stapler, is also introduced, which can reduce the incidence of anastomotic leakage by 47%.

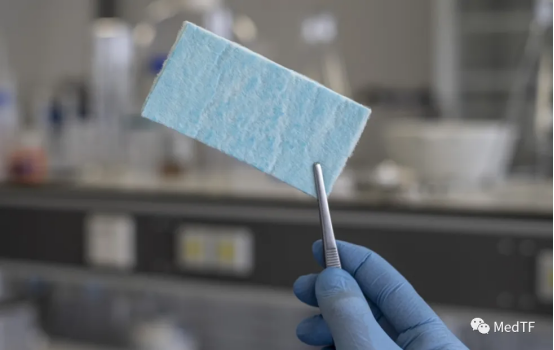

ETHIZIA, the world's only double-sided hemostatic patch, has also been approved by the FDA for use as an adjoint hemostatic agent for destructive bleeding in the internal organs in addition to the cardiovascular and nervous systems. ETHIZIA is able to stop bleeding in 30 seconds, on average six times faster than leading fibrin sealers.

- Orthopaedic field

The orthopedic robot VELYS has been approved by the FDA for clinical use in single-compartment knee replacement (UKA).

- Cardiovascular field

This is an area of focus for J&J, and one where J&J has the most priority platforms (each with annual sales of at least $1 billion). In addition to acquisitions, in addition to acquisitions, Johnson & Johnson has also launched a number of innovative products through self-research.

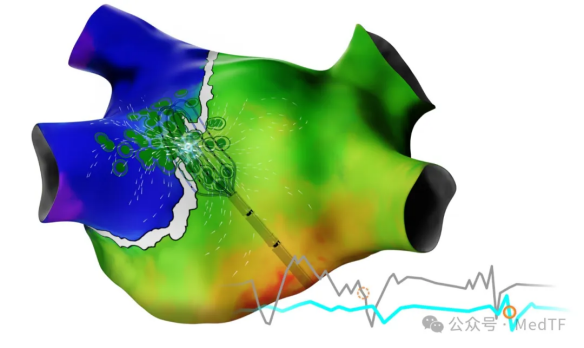

Its first PFA product, VARIPULSE, was approved in the European Union and Japan and is expected to receive FDA approval this year.

In addition, the new 4D ICE: NUVISION NAV, the new AI CARTO 3, the grid high-density mapping catheter OPTRELL TRUEref and the removable spring coil Cerepak were introduced. Intelligent CARTO 3 is the foundation of Johnson & Johnson's electrophysiology field, and it is also the guarantee of maintaining the technological advantage with Poco, Medtronic and Abbott.

NO.2 Abbott Research and development spending: $2.74 billion, or 10.2% of sales

With the end of the epidemic, Abbott also temporarily withdrew from the first brother competition. In 2023, there is a big gap between its medical device related business and Medtronic and Johnson & Johnson, and it needs greater investment to catch up with the top two. Compared with Johnson & Johnson, Abbott has not invested much in mergers and acquisitions, which is also the reason for the gap with Johnson & Johnson. However, in terms of R&D investment, it is not inferior to Johnson & Johnson, and R&D investment exceeds 10% of sales.

Due to the huge investment in research and development, it has achieved good results in product innovation.

- Cardiovascular field

AVEIR DR, the world's first two-chamber leadless pacemaker, has been approved by the FDA, providing a new treatment option for patients suffering from slow heart rhythm.

TriClip, the star product, is also approved by the FDA to provide a treatment option for tricuspid valve regurgitation (TR) or leakage of the tricuspid valve in the United States. The launch of TriClip also guarantees Abbott's leadership in structural heart disease.

TriClip, the star product, is also approved by the FDA to provide a treatment option for tricuspid valve regurgitation (TR) or leakage of the tricuspid valve in the United States. The launch of TriClip also guarantees Abbott's leadership in structural heart disease.

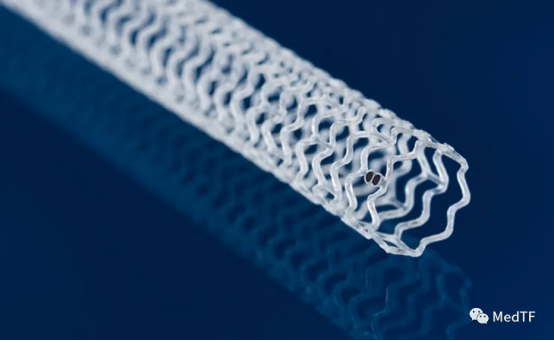

The absorbable stent Esprit BTK is also approved by the FDA, although Esprit BTK is only intended for patients with chronic limb threatening ischemia (CLTI). But it's still significant for Abbott, seven years after the failure of Absorb BVS, to once again confirm that absorbable stent technology is safe and reliable. Let the majority of patients with coronary heart disease see the hope of implanting absorbable stents in the future.

In electrophysiology, Abbott is a little slow. It slowly unveiled its first PFA product, the Volt, late last year. Although a little slow, it's better than nothing, and the Volt has design features.

- Diabetes field

Abbott's latest CGM product, Lingo, was approved by the FDA and is the second over-the-counter CGM product. It not only provides Abbott with anti-DEXCOM products, but also has a larger potential application space (ketone, lactic acid, ethanol can be monitored).

NO.3 Medtronic

NO.3 Medtronic

R&d spending: $2.70 billion, or 8.6% of sales

The epidemic + the replacement of the helm has made Medtronic lose its past vigor, and the most news about the first brother in the past two years is layoffs and recalls. There is no aggressive merger and acquisition before the epidemic, and Medtronic's market value is in a mess (hovering at $100 billion, completely not showing the value of a brother), and the chief executive is also taking the lead in cashing out (how not optimistic about his company). Although the first brother has not developed as expected in the past two years, the investment in research and development is still good. This is also where it remains ahead in several areas.

- The field of hypertension

After 14 years, Symplicity Spyral has finally received FDA approval, opening up a new treatment option for refractory hypertension. This is Medtronic's most important product in the cardiovascular segment, and Medtronic has high hopes for it (Symplicity Spyral is expected to bring great commercial value).

- electrophysiology

Medtronic is a latecomer in the field of electrophysiology, not only has a star product Arctic Front that makes Medtronic turn over in the field of electrophysiology. And in the era of great changes in electrophysiology, it is also able to beat Poco to the top, and its PFA product PulseSelect was the first to obtain FDA approval.

In addition to the PulseSelect, Medtronic's left auricular closure Penditure was approved by the FDA. Make Medtronic atrial fibrillation solutions more complete.

In addition to the PulseSelect, Medtronic's left auricular closure Penditure was approved by the FDA. Make Medtronic atrial fibrillation solutions more complete.

- TAVR field

In the field of TAVR, Medtronic not only launched the latest generation of TAVR products -Evolut FX+, but also in the Sapien head-to-head researchers, the Evolut series showed better clinical results.

- Diabetes, surgical field

In the field of diabetes, Medtronic faces increasing pressure from external challenges. It wanted to narrow the gap with rivals through acquisitions, but it has not been successful. The potential acquisition target had serious intellectual property issues and had to be abandoned.

In the surgical field, Hugo had high hopes, but commercial progress in Europe was less than expected. Before clinical trials in the United States were completed, Intuitive, the strongest competitor, had to face Da Vinci 5, which crushed all similar products.

NO.4 Philips

R&d spending: $2.05 billion, or 10.5% of sales

These two years are not good for Philips, its products continue to fall into the abyss of recalls, ventilators, MR, CT, X-ray machines and so on. Among them, ventilators are the most serious, which not only has the largest number of first-level recalls, but also faces huge compensation and fines. In the United States alone, personal injury cases caused by ventilators have paid 1.1 billion dollars in settlements.

Despite previous problems with the quality of its products, Philips has never reduced its investment in research and development. It is also expected that Philips will not only introduce innovative products, but also improve product quality.

Sphere of influence

LumiGuide, a new optical tube guidance system approved by the FDA, is a step toward radiation-free interventional imaging for cardiovascular intervention.

Cardiovascular field

The Duo venous stent is FDA approved for the treatment of chronic venous insufficiency (CVI) with symptomatic impaired venous discharge.

NO.5 Roche

R&d spending: $2.04 billion, or 13.0% of sales

Roche continued to dominate the IVD sector last year, with sales well ahead of No.2 Abbott. In order to strengthen its dominance in the field of IVD technology, Roche has invested very heavily (research and development investment accounts for 13% of its sales, far more than Abbott). These R&D investments are mainly focused on NGS, CGM, mass spectrometry, core laboratory business and other areas.

The large proportion of research and development investment also makes Roche fruitful. Last year Roche received FDA approval for major products:

Automatic chemiluminescence analyzer: cobas 6800/8800 Molecular System, cobas 5800;

Fluorescence Assay for COVID-19 and Influenza: cobas Xpert SARS-CoV-2/Influenza A&B Combo assay, cobas SARS-CoV-2/Influenza A&B Assa;

Rapid antigen detection reagent: cobas Liat SARS-CoV-2;

Rapid antibody detection reagents: cobas SARS-CoV-2, cobas Liat SARS-CoV-2;

New generation qPCR system: LightCycler PRO.

NO.6 Siemens

R&d spending: $2.01 billion, 8.7% of sales

Siemens' huge R&D investment in imaging is beginning to bear fruit, but the cardiovascular field has been hit hard. Once a promising vascular interventional robot, Corindus, has had to face exit from the heart disease business because its technology cannot meet real clinical needs. Siemens can only hope for the future of Corindus in the field of neural intervention.

In the field of imaging, a number of products were approved for market. Examples include the 1.5-T on-board magnetic resonance Magnetic Resonance Magnetom Viato.Mobile, Mammomat B. Brailliant, and the CIARTIC Move, a mobile C-arm with automatic driving functions.

NO.7 Danaher

R&d spending: $1.5 billion, or 6.3% of sales

Last year was a big year for Danaher's business, with sales down 24 percent compared to 2022. At the same time, the M&A king also began to transform. Last year Danaher split its Environmental and Applied Solutions division, allowing it to focus more on life sciences and diagnostics as an innovator in both areas.

Compared to the Danaher volume, the investment is relatively small. Therefore, in 2023, we will not see a bright new product on the market.

NO.8 Poco

R&d spending: $1.41 billion, or 9.9% of sales

Porco is one of the top 20 companies with the greatest focus on research and development, with at least three products nominated for Galen Awards in each of the last five years. At the same time, it is also one of the most acquired companies in the past two years, with the acquisition of Silk Road, Relevant Medsystems, Axonics, and other acquisitions, which strongly strengthen the Poco product line. However, compared with Johnson & Johnson's big deal, the Poco acquisition is small and beautiful, and the main difference is one.

Poco invests more than $1 billion annually, which has also led to FDA approval of its products in several areas.

electrophysiology

Poco pioneered PFA treatment technology, and its first PFA product, Farapulse, was approved by the FDA.

The WATCHMAN FLX Pro, an updated version of the WATCHMAN, hit the market last year. In addition to PFA and WATCHMAN, Polco's cryoablation balloon POLARx has also been approved by the FDA, making Polco the world's largest solution company for the treatment of atrial fibrillation.

The WATCHMAN FLX Pro, an updated version of the WATCHMAN, hit the market last year. In addition to PFA and WATCHMAN, Polco's cryoablation balloon POLARx has also been approved by the FDA, making Polco the world's largest solution company for the treatment of atrial fibrillation.

- Coronary area

Agent DCB has been approved by the FDA as the world's first drug carrier balloon for the treatment of restenosis in coronary stents.

- Urology

Poco introduces its new disposable ureteroscope LithoVue Elite, the world's first ureteroscope with pressure monitoring.

NO.9 Stryker

R&d spending: $1.39 billion, or 6.8% of sales

Stryker is one of the best performing medical device companies in recent years, and its market value has reached $130 billion, far more than the first device. But it spends relatively little on research and development -- $1.39 billion -- less than Porco. Because of low investment, Stryker did not have any heavyweight products on the market last year.

This year Stryker is expected to launch Mako for new indications - the Mako spine robot and the Mako Shoulder surgical robot.

NO.10 BD

R&d spending: $1.24 billion, or 6.4% of sales

BD's R&D output last year was the same as Stryker's, with no eye-catching products. Only a few small products have been approved by the FDA, such as MiniDraw, a fingertip blood collection system, and Onclarity HPV, a self-collection kit for cervical cancer screening. However, this year BD acquired Edwards' Critical Care product line for $4.2 billion, which strengthens BD's portfolio of smart connected care solutions.

NO.11 GE

R&d spending: $1.21 billion, or 6.2% of sales

Once the leader of GPS, it now ranks only at the bottom. In addition to the management was too bad, its investment in research and development, mergers and acquisitions is also one of the reasons for its decline. Look forward to GE Healthcare after the separation, independent operation can return to the peak. GE launched some new products last year, albeit on a shoestring. Examples include the Allia IGS Pulse system, the head magnetic resonance (MR)Signa Magnus, and more.

NO.12 Edward

R&d spending: $1.07 billion, or 17.8% of sales

Edward is undoubtedly the highest proportion of research and development investment among medical device giants, reaching 17.8%. So much investment in research and development has led to rapid sales growth, which reached 12% last year.

High research and development investment has also enabled Edward to launch a number of star products, of which EVOQUE is undoubtedly the star of stars.

EVOQUE: The first transcatheter tricuspid valve replacement product approved by the FDA to improve the health of symptomatic patients with severe TR. The EVOQUE launch will also allow Edwards to continue its rapid growth.

NO.13 Intuitive

R&d spending: $1 billion, or 14% of sales

In the face of the growing soft tissue surgical robot market, Intuitive widened the gap with its competitors by constantly increasing investment.

Following a decade of heavy investment, Intuitive launched Da Vinci 5, a groundbreaking soft-tissue surgical robot, earlier this year. The Da Vinci 5 not only has more than 150 technical innovations compared to the Da Vinci Xi, but more importantly, it has achieved a technological generation difference with the competition.

This allows Da Vinci 5 to harvest the high end of the market and Da Vinci Xi to harvest the low end.

Source: MedTF