-

![]() Nov 20, 2025

Nov 20, 2025Hem-o-lok: Teleflex Launches Plus Version Ligating Clip | First Innovation in Two Decades

Teleflex announced via its social media channels that its new version of Hem-o-lok — the Hem-o-lok PurplePlus — has received FDA approval for market launch. The Hem-o-lok PurplePlus is a large ligating clip that can be applied using a smaller applier.

-

![]() Mar 25, 2025

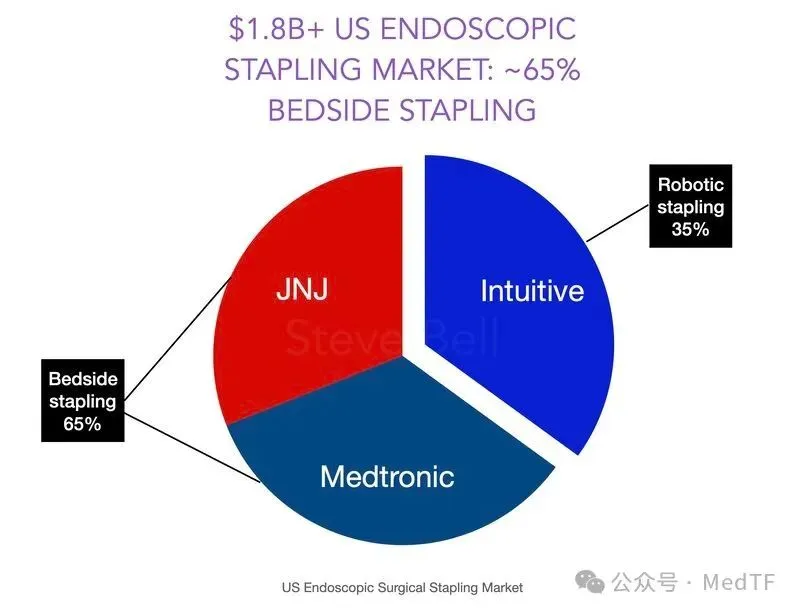

Mar 25, 2025Stapler Medical Device Industry Market Analysis Report

The global surgical staplers market size is valued at USD 4.5 billion in 2024 and is expected to reach USD 8.7 billion by 2032, at a compound annual growth rate (CAGR) of 7.5% during the forecast period.The strong market growth is mainly driven by the increase in the number of surgeries worldwide and the advancement of surgical anastomosis techniques.

-

![]() Mar 11, 2025

Mar 11, 2025MicroAngioscope:Disposable Cardiovascular Endoscope

Vena Medical announced that its disposable vascular endoscope, MicroAngioscope, has been awarded the FDA "Breakthrough Device" designation. This is the first vascular endoscope to receive the FDA "Breakthrough Device" designation.

-

![]() Mar 06, 2025

Mar 06, 2025SureForm from Intuitive

When we talk about staplers in China, the first thing that comes to mind is Johnson & Johnson and Medtronic. These two companies once occupied more than 90% of the stapler market in China. Now, with China's large-scale centralized procurement and the continuous emergence of high-quality domestic products, their market share is declining sharply. Chinese staplers have begun to take the initiative, and Johnson & Johnson and Medtronic may become Others in the future.

-

![]() Feb 24, 2025

Feb 24, 20252025 Must read for foreign investors in China!

-

Feb 21, 2025

Olympus to reorganize for growth

Recently, Olympus Corporation is about to undergo a comprehensive restructuring of its business operations. Company representative executive officer and former CEO Yasuo Takeuchi announced the changes during the release of fiscal 2025 third-quarter results. Takeuchi took over on an interim basis after Stefan Kaufmann pleaded guilty to drug charges in December. The reorganization is designed to improve the company's operational efficiency and further focus on patients and customers.